Dcaa Accounting System Audit

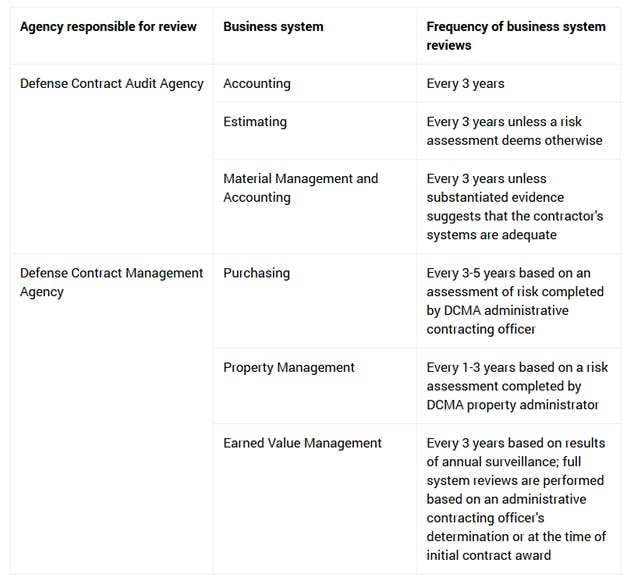

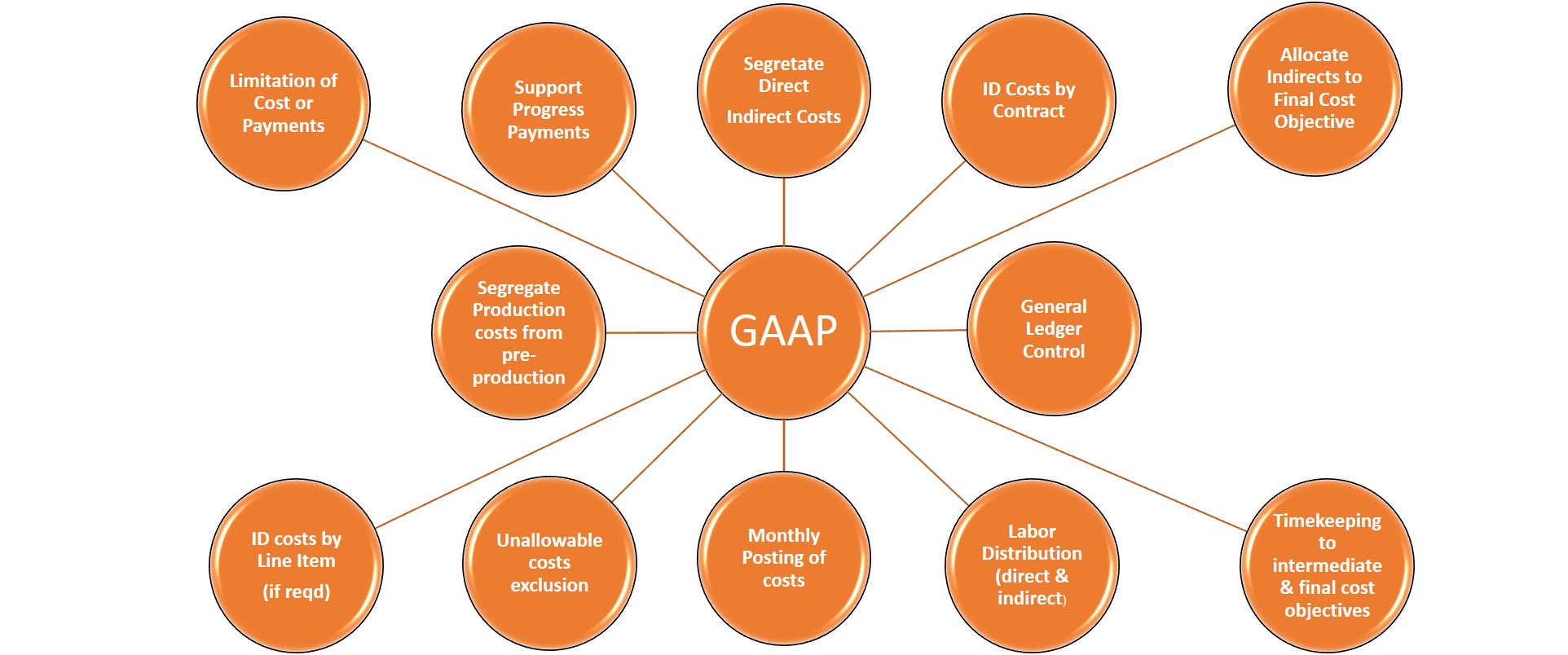

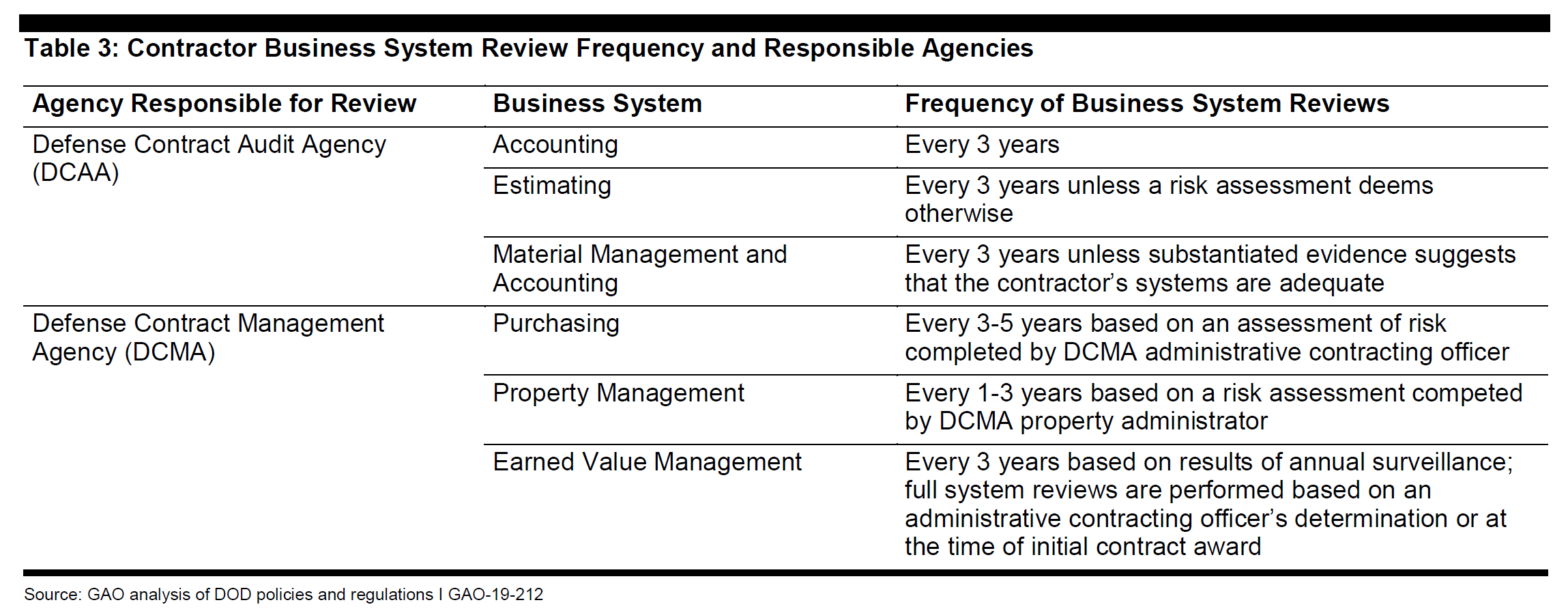

Dcaa accounting system audit. Incompatibility of records often from inclusion of unallowable costs. These requirements are defined by FAR 154. The Material Management and Accounting System MMAS audit is conducted to examine contractor compliance as prescribed in DFARS 252242-7004.

DFARS 2427502b DCAA can no longer at least temporarily perform audit services for non-defense agencies. Obtain an understanding of the contractors compliance with DFARS 252242-7004d. Compre online Surviving a DCAA Audit.

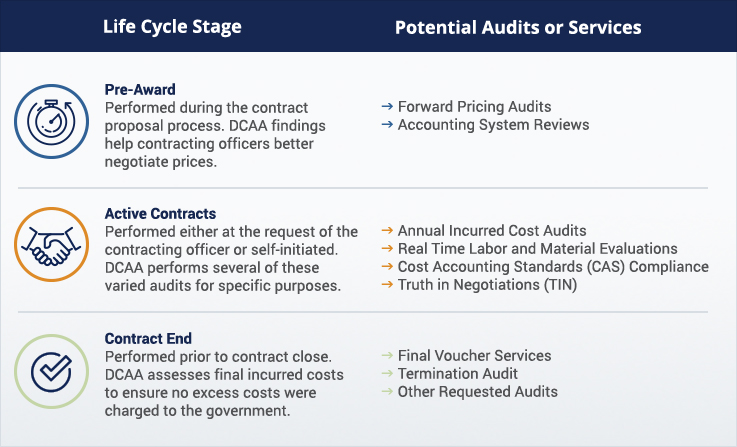

DCAA Services Page 10 Incurred Cost Audit Interim Payment Monitoring Price Proposal Audit Business System Compliance Preaward Accounting System Audit Disclosure Statements Cost Realism Audit CAS Compliance Forward Pricing RatesFactors Audit Real Time Labor and Material Audits CostRate Information Truth in Negotiations Compliance Termination. The Accounting System de Avery Stephen a na Amazon. Specifically DCAA has been requested to perform a pre-award accounting system evaluation to determine whether your accounting system is adequate according to Federal Acquisition Regulations FAR for award of future government contracts.

PREAWARD SURVEY The post award accounting system audit DMIS Activity Code 17741 is performed at non-major contractors subsequent to contract award to test compliance with DFARS 252242-7006c. Our staff consists of former DCAA auditors and supervisors CFOs and controllers government compliance experts and ACOs so they understand thoroughly what an accounting system audit entails what practices must be in place to receive an adequate opinion what auditors will be looking for during their accounting system audits how potential negative opinions may be addressed before an. They do a more thorough job reviewing accounting items testing the system.

DCAA is currently preparing a new revision of that Accounting System Review audit program and you cant see it until its officially published on the DCAA website. DCAA Software offer Affordable options for DCAA Compliant Accounting Software DCAA Compliant Timekeeping Software DCAA Accounting System Audit for for Government Contracts Easy-To-Use Integrated Accounting Software for Government Contractors. They audit or review systems and provide recommendations to the contracting officer who holds the responsibility and authority for approving a system.

Preaward Accounting System Audit. Contact DCAA Systems Solutions at. Try to avoid these.

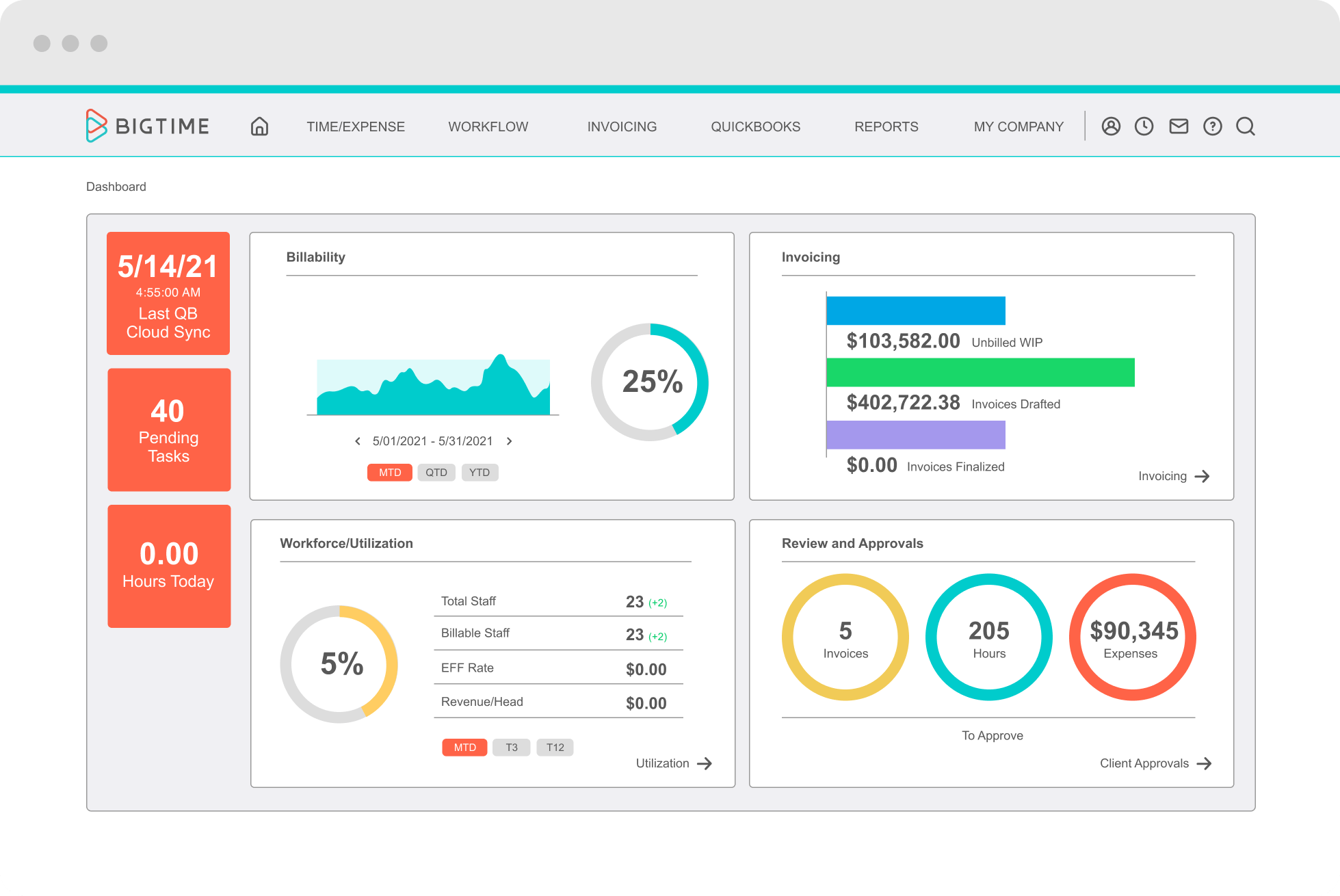

Fieldwork generally lasts one to. Any ERP or accounting software could be classified as DCAA compliant if it passes the required accounting system audit based on Government Auditing Standards from the Yellow Book.

Contact DCAA Systems Solutions at.

The major objectives of this audit are to obtain an understanding of the accounting system to appropriately complete the Preaward Survey of Prospective Contractor Accounting System SF 1408 and to opine as to whether the design of the contractors system is acceptable for the award of a prospective Government contract. Preaward Accounting System Audit. The DCAA conducts Post-Award Audits after the contractor has been working on the awarded job for roughly three to six months generally. Government contractors span a huge variety of different business models from small businesses to. DCAA approves an accounting system based on a set of evaluation criteria. They audit or review systems and provide recommendations to the contracting officer who holds the responsibility and authority for approving a system. Would you like more information on our DCAA mock audits. Find out the top 10 reasons why the DCAA will audit you. 1 be aware of why the audit is a requirement 2 understand what the.

Find out the top 10 reasons why the DCAA will audit you. Instead the auditors will consider how you have configured the software of your choice and if the system and accounting processes that support it meet the control objectives and the requirements outlined in the SF 1408. The DCAA Management Information System DMIS User Guide available on DCAAs Intranet is the principal reference and source of information for the overall Agency planning process. Specifically DCAA has been requested to perform a pre-award accounting system evaluation to determine whether your accounting system is adequate according to Federal Acquisition Regulations FAR for award of future government contracts. Being familiar with the various types of audits that may be conducted however will help a contractor be prepared. The DCAA conducts Post-Award Audits after the contractor has been working on the awarded job for roughly three to six months generally. Any audit can be cause for anxiety.

Posting Komentar untuk "Dcaa Accounting System Audit"